Source: https://www.recenter.tamu.edu

Texas’ economic expansion maintained momentum after leading the nation in gross domestic product (GDP) growth in the second quarter. Improvements in the manufacturing and energy industries generated a large share of the increased activity. Despite a dip in oil prices, Texas continued to ramp up production above record levels. Manufacturers noted steady demand and expanded operations accordingly. Nonfarm employment extended its two-year growth spurt and pulled the unemployment rate down to its lowest level in four decades. Wages showed signs of increasing due to labor market tightness, but inflationary pressures negated the net impact. Stagnant purchasing power failed to curtail Texans’ confidence in the economy. While survey data reinforced optimism for both consumers and producers, several risk factors are growing. The combination of rising interest rates, oil-price volatility, and a slowdown in the global economy could challenge the current business-cycle expansion.

Texas led the nation in second quarter GDP growth at 6 percent on a seasonally adjusted annualized rate (SAAR), led by gains in the energy and manufacturing industries. Wholesale trade and professional, scientific, and technical services also posted solid quarterly gains. Nondurable goods manufacturing was the largest drag on both the national and state economies, followed by the finance and insurance industry.

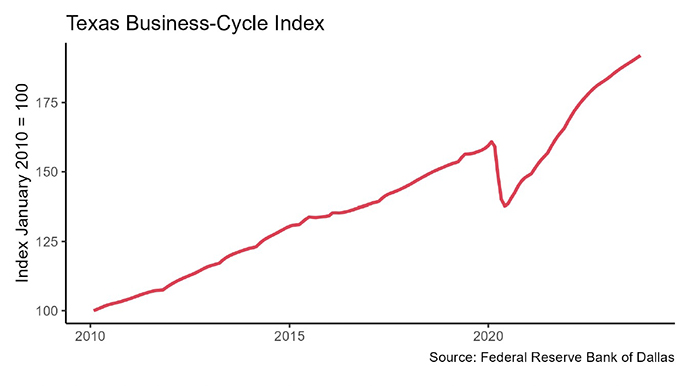

Solid economic activity through October pushed the Dallas Fed’s Texas Business-Cycle Index up 5.5 percent SAAR for the first time since 2014. Payroll expansions and historically low unemployment supported growth across the state. The Austin and Houston business-cycle indices boomed at 7.8 and 6.7 percent, respectively. Economic activity accelerated 4.8 and 3.6 percent in Dallas and Fort Worth, respectively, after a summer slowdown. A similar improvement in San Antonio ticked the local business-cycle index above 2 percent to its highest level since February.

Continued strength in the Texas value of the dollar pulled the Texas Leading Economic Index (a measure of futuredirectional changes in the business cycle) down slightly, but growth in the overall economy maintained a favorable outlook. The Dallas Fed’s 2018 statewide employment forecast improved to 2.9 percent amid strong hiring in October. Annual job growth has averaged 2.1 percent since 1991. Healthy market conditions pushed the Texas Consumer Confidence Index to a record high as the business cycle approached its longest expansion in state history.

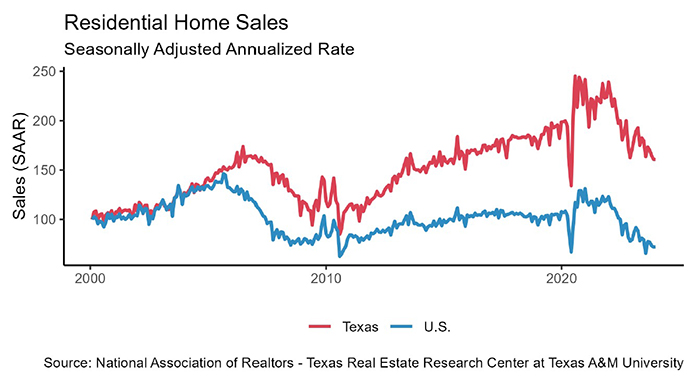

Interest rates jumped to a seven-year high amid a booming national economy and rising inflation-expectations. The ten-year U.S. Treasury bond yield reached 3.15 percent for the first time since 2011, while the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate elevated above 4.8 percent. Higher interest rates disproportionately affected refinance mortgage applications in Texas, which slid 38 percent since January. Rising rates also pulled down mortgage applications for new-home purchases, but YOY growth remained positive.

Texas housing sales rebounded 11.8 percent in October but remained on a flat trajectory. Current residential construction activity, measured by the Residential Construction Cycle (Coincident) Index, reached its highest level since 2007 as construction employment and wages continued to elevate. This momentum, however, may moderate in the fourth quarter as the Texas Residential Construction Leading Index (RCLI) declined for the second straight month. Rising interest rates, a dip in housing starts, and fewer multifamily permits weighed on the residential construction outlook, but robust economic growth upheld a solid foundation. (For additional housing commentary and statistics, see Texas Housing Insight at recenter.tamu.edu.)

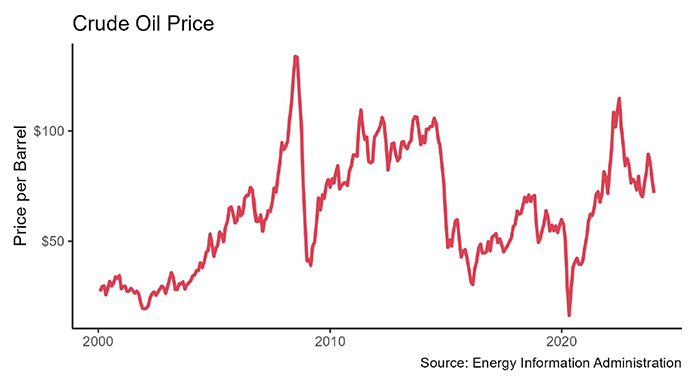

The average West Texas intermediate crude oil spot price dipped below $71 per barrel with more downward pressure expected in coming months due to decreased global demand and rising U.S. production. Texas reached record-level production above 4.6 million barrels per day in September2. The number of active rigs in the state rebounded to 525 after a three-month slide. The Henry Hub natural gas spot price jumped above $3.2 per million BTU (British thermal units) amid below-average inventory levels heading into winter.

Texas added 32,300 nonfarm jobs, the largest gain since May. Labor force participation balanced at 63.7 percent following a third-quarter correction. The unemployment rate sank to 3.7 percent for the first time in series history (beginning in 1975), while initial unemployment insurance claims held near a 36-year low. The unemployment rate was even lower in the major metros. Unemployment balanced at 2.8 in Austin, followed by San Antonio at 3.2 percent. North Texas was not far behind with 3.3 percent unemployment. Houston maintained the highest rate but improved below 4 percent for the first time since 2001.

Real private hourly earnings dropped 1.6 percent year over year (YOY) as inflation ate away nominal gains. Real earnings declined across the major metros with San Antonio posting the largest drop at 2.3 percent YOY. Houston extended a three-year downturn despite improvements in the heavily weighted energy industry. Austin and Dallas earnings declined 0.9 and 1.9 percent, respectively, after a solid summer. Fort Worth was the exception where YOY hourly earnings rose for the fourth consecutive month. More robust data from the Quarterly Census of Employment and Wages (QCEW) suggest an improved earnings environment, but the data release lags about six months.

Dallas and Houston contributed to nearly half of the state’s job increase with 8,500 and 7,100 new positions, respectively, primarily in professional/business services and leisure/hospitality. Houston’s payroll expansion moderated, however, as construction activity returned to more typical levels. Employment bounced back in Fort Worth with 3,200 jobs, largely in manufacturing, education/health services, and leisure/hospitality. North Texas’ retail sector continued to suffer, shedding 6,100 jobs since June. Retail employment climbed in Austin, but contractions in construction and professional/business services resulted in only 1,900 jobs on net. San Antonio payrolls reversed course after lagging all summer, generating positive job growth for the second straight month. Employment expanded in most of the service sector. San Antonio’s professional/business services sector lost a total of 6,900 jobs this year.

The energy industry supported growth in Texas’ goods-producing sector, but construction and manufacturing payrolls calmed after a strong first half of the year. Manufacturing lost 500 jobs across the state, but the primary regions trended positively to begin the fourth quarter. Houston and Fort Worth added 7,200 and 1,900 industry jobs, respectively, over the past three months, while Dallas extended a five-month hiring streak. On the other hand, manufacturing employment remained stagnant in Austin and San Antonio where it accounts for less than 5 percent of the region’s workforce.

Stagnant wages weighed on the manufacturing industry but are also subject to Quarterly Census of Employment and Wages revisions. Hourly manufacturing earnings ticked up to $23.91 in October but remained negative on the year after accounting for inflation. Fort Worth paid the highest industry wages in the state at $34.73, more than $10 per hour above Houston ($22.25) and San Antonio ($19.58). Hourly manufacturing earnings in Dallas flattened similarly since the beginning of 2016.

Weak earnings data contrast the Dallas Fed’s Manufacturing Outlook Survey, in which a third of respondents increased wages and benefits. Manufacturing activity accelerated with widespread increases in production, new order volumes, and the number of shipments. More than half of respondents paid higher prices for raw materials as tariffs cut into the industry’s margins. Nevertheless, the manufacturing outlook remains positive with steady production and demand.

The construction industry added 1,500 jobs, the fewest since Hurricane Harvey hit last fall. Houston accounted for most of the monthly slowdown after adding 29,100 positions through 12 months after the storm. Real hourly construction earnings trended upward, rising 3.7 percent YOY, but remained nearly $2 below the national average. The ground-breaking of the $175 million Methodist Medical Center Campus in Midlothian (DFW) pushed total construction values into positive YOY growth, but nonresidential activity as a whole remained a drag. Retail construction values sank to a record low after adjusting for inflation as online operations expanded. Austin’s hotel construction activity continued to slow, but eight new projects in the pipeline should lift values in coming months. Texas residential construction values dipped for both single and multifamily housing, after steady growth in the first half of the year.

The service-providing sector posted its largest increase since February with 27,000 new jobs. The gains were broad-based with only professional and business services declining on the month, due to 7,000 fewer jobs in administration/support and waste management/remediation services. The professional, scientific, and technical services subsector maintained steady growth. Hiring accelerated in trade-related industries and stabilized in the public sector. Accommodation and food services extended an eight-month hiring wave, adding nearly 24,000 jobs YTD.

The Dallas Fed’s Service Sector Outlook Survey indicated positive employment trends as a fifth of respondents added jobs and increased wages/benefits. A third of service providers generated higher revenues and anticipate an improved outlook in the next six months. Complaints of over-regulation, rising interest rates, and import tariffs weighed on long-run confidence.

The healthy national economy pushed the U.S. Consumer Price Index (CPI) up 2.5 percent YOY, despite lower crude oil and gasoline prices. The cost of energy services (electricity and natural gas) posted the largest monthly gain since early 2014. A rebound in used-automobile prices supported 2.1 percent YOY growth in the core inflation rate. Inflationary pressures were more modest in Houston, where the local CPI rose 2.2 percent YOY. Cheaper food and beverages as well as gasoline prices held inflation around the 2 percent benchmark.

Texas’ total commodity exports reached a record high in real terms, maintaining double-digit YOY growth. Petroleum, chemicals, and computer/electronics products lifted manufacturing exports up 9.5 percent YOY, more than twice the national growth rate. On the other hand, crude oil exports fell 5.8 percent after reaching record levels in September. Currency fluctuations hindered additional export growth. The Texas trade-weighted value of the dollar3 jumped 15.7 percent YTD in September, reaching its highest level in over a decade and making domestic goods relatively more expensive for our trade partners.

The international composition of Texas trade shifted amid policy changes and global politics. Exchanges with Mexico and Canada flattened since the first quarter, reducing their share of Texas exports to less than 44 percent. Exports to China accounted for less than 3 percent of the Texas total, falling below shipments to the Netherlands, Japan, South Korea, and Brazil. Declines in agriculture and oil/gas accounted for most of the drop in exports to China.

____________________

1 All monthly measurements are calculated using seasonally adjusted data, and percentage changes are calculated month-over-month, unless stated otherwise.

2 The release of Texas crude oil production typically lags the Outlook for the Texas Economy by one month and these data are not seasonally adjusted.

3 The release of Texas retail sales and trade-weighted value of the dollar data typically lags the Outlook for the Texas Economy by one month.

Recent Comments